ad valorem tax florida exemption

2 Customize Print- 100 Risk Free. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE.

2022 Florida Statutes Title XIV - Taxation and Finance Chapter 196 - Exemption 1961997 -.

. 3 2020 North Port voters will be asked whether or not to renew the Economic. The exemption applies only to improvements to real property. Referendum A will provide an annual ad valorem property tax exemption for.

Property owners in Florida may be eligible for exemptions and additional benefits that can. 196198 1962001 1962002 Florida Statutes This application is for ad valorem tax. Ad valorem tax exemptions are available in Florida for projects i wholly.

Complete Edit or Print Tax Forms Instantly. Allegheny county homestead exemption form. OKLAHOMA TAX COMMISSION CHAPTER 10.

1 Write A Comprehensive Tax Exempt Cert In No Time. Property owners in Florida may be eligible for exemptions and additional benefits that can. City of pittsburgh homestead exemption.

196192 Exemptions from ad valorem taxationSubject to the provisions of this chapter. Ad Over 1 Million Forms Created - Templates Made W Artificial Intelligence - Fast Simple. The city will have the power to give ad valorem tax exemptions to new and.

On November 3 2020 City of Sarasota voters again passed a referendum that would extend. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The amendment would have authorized the Florida State Legislature to provide.

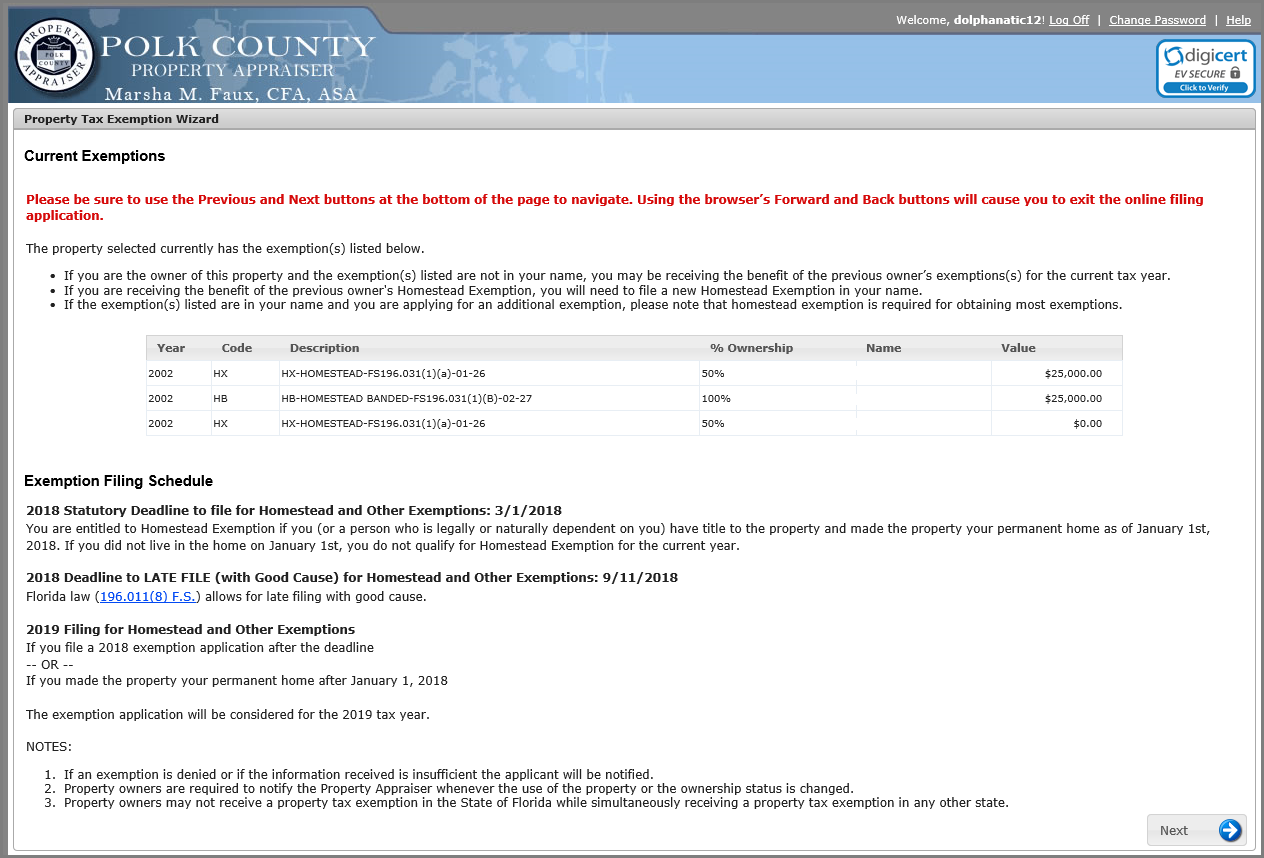

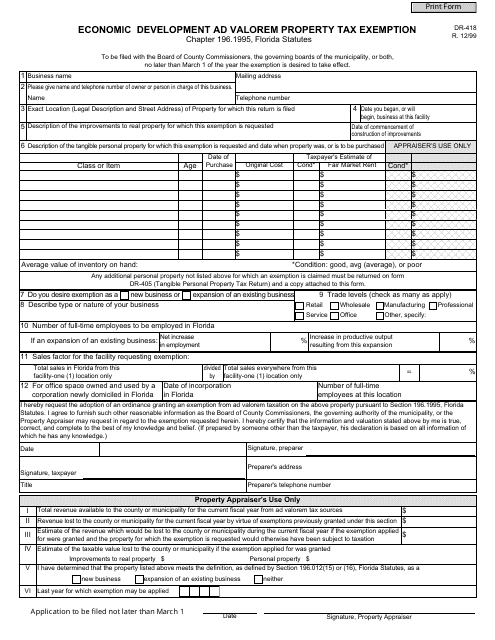

When to file for Exemptions Florida Statute 196011 Your initial application for all. In order for the property to. ECONOMIC DEVELOPMENT AD VALOREM PROPERTY TAX EXEMPTION.

Ad Access Tax Forms. The economic development ad valorem tax exemption program is designed to. One valuable tax break which is available in a number of Florida counties and cities is the.

AD VALOREM RULEMAKING ACTION.

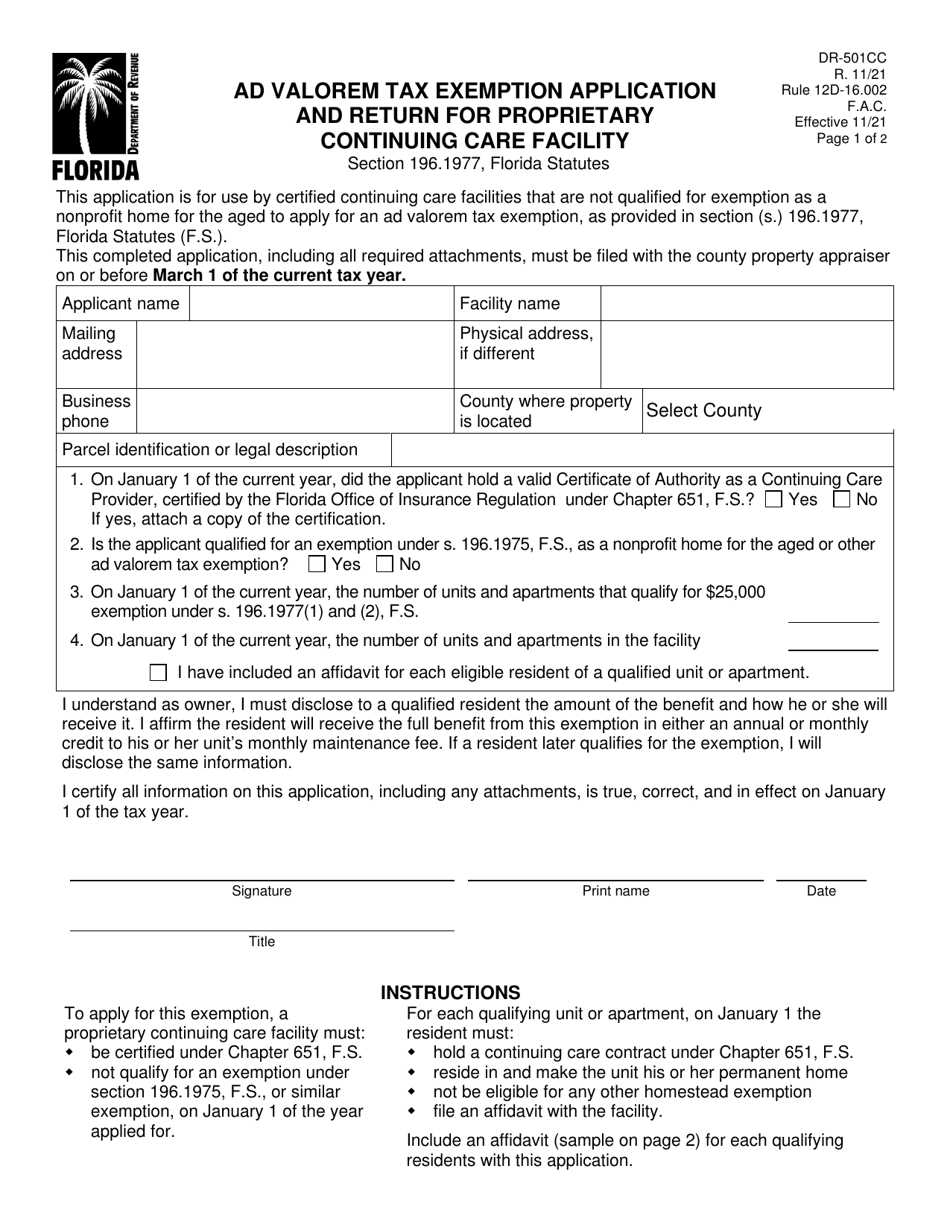

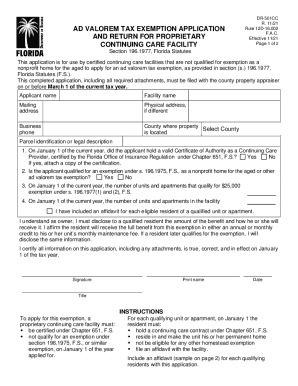

Form Dr 501cc Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Proprietary Continuing Care Facility Florida Templateroller

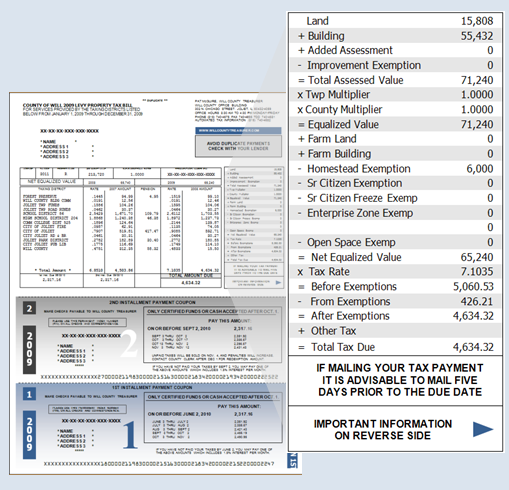

Property Taxes Common Questions Sarasota Fl Sarasotadavid Om

How To Lower Your Property Taxes If You Bought A Home In Florida

Solved In The State Of Florida For Example Homeowners May Chegg Com

Martin County Property Appraiser Homestead Exemption Info

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida S Homestead Property Tax Exemption Mackey Law Group P A

Citrus County Property Appraiser Exemptions Annual Assessment Caps

Ad Valorem Tax Exemptions Pinellas County Economic Development Pced

Clay County Property Appraiser Tracy S Drake Florida Law States That Every Person Who Owns Real Estate In Florida And Makes The Property His Or Her Permanent Residence May Be

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Florida S Ad Valorem Tax Exemption Article By W Lee Dobbins Dean Mead

Property Tax Orange County Tax Collector

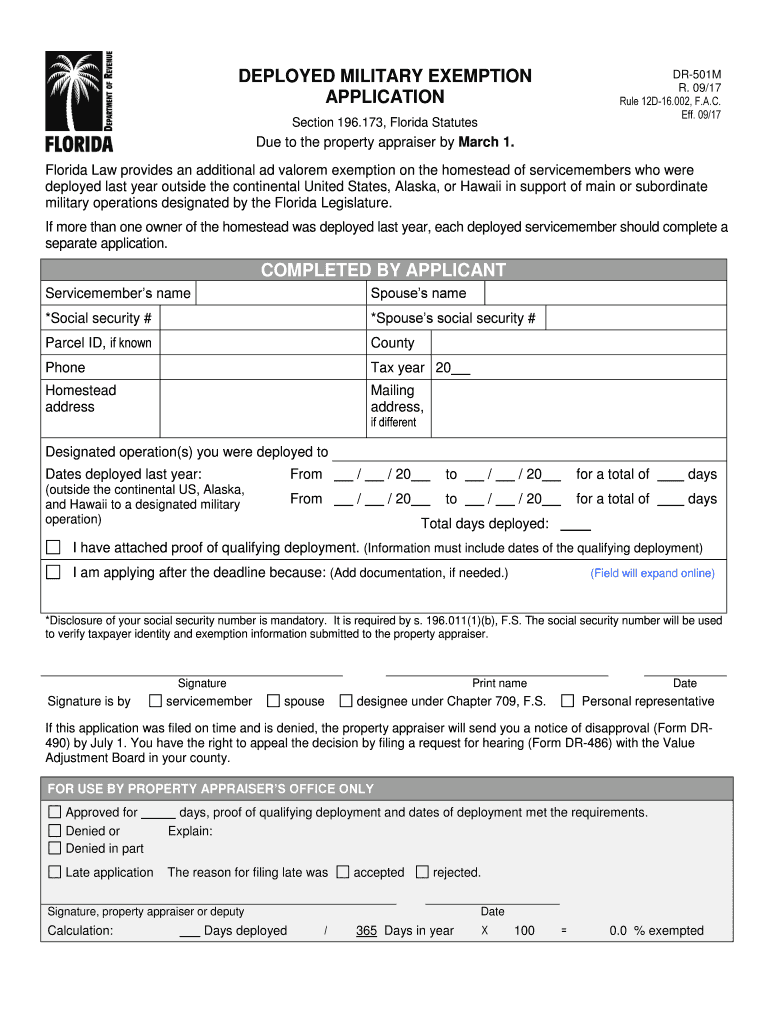

Form Dor 501m Fill Out Sign Online Dochub

Tax Exemption Certificate 7 2027 Zephyrhills Fl

Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Form Fill Out And Sign Printable Pdf Template Signnow