portability estate tax return

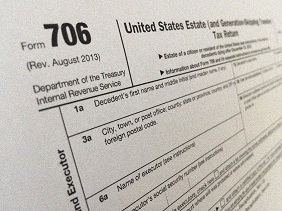

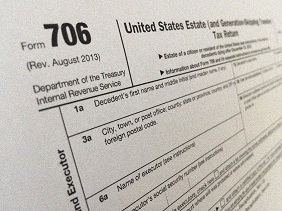

Ad Practical And Affordable CPE Courses For CPAs. Under Section 2010c5A of the Internal Revenue Code the Code the estate of a decedent who died survived by a spouse after December 31 2010 which is not otherwise required to file a Form 706 United States and Generation-Skipping Transfer Tax Return may make a portability election allowing such decedents federal.

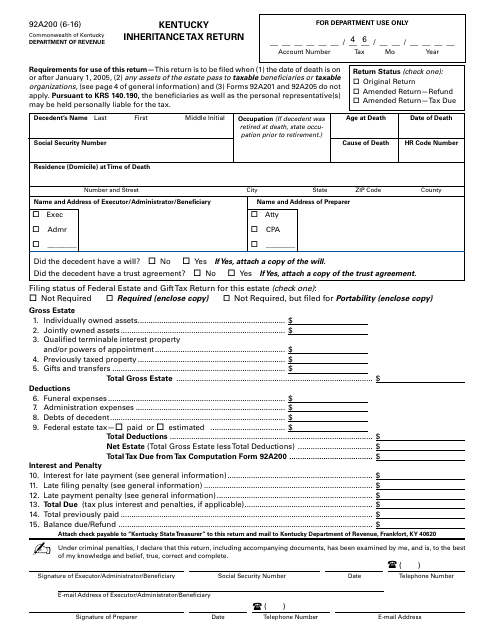

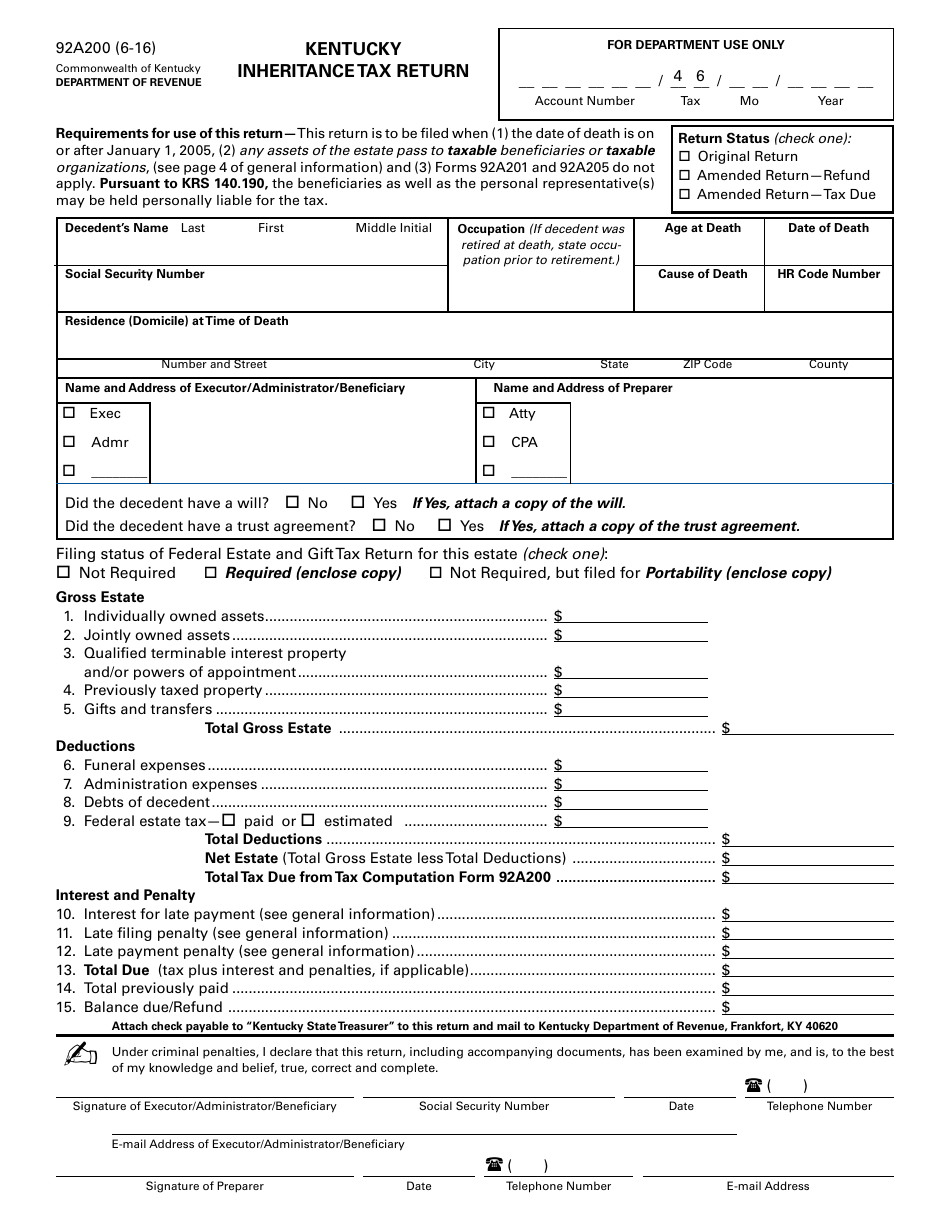

Form 92a200 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return Kentucky Templateroller

2017-34 the IRS provided a simplified method for obtaining an extension of time under Regs.

. You must adhere to the rules and regulations of the receiving PHA which may differ from the initial voucher issued by NYCHA. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can. Through a portability election to port the DSUE on a timely filed Estate Tax Return or an Estate Tax Return filed late consistent with the terms of Revenue Procedure 2022-32 the.

Time To Finish Up Your Taxes. Ad File For Free With TurboTax Free Edition. Learn With CPA Self Study.

Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. Before this enactment of estate tax exemption portability the unused estate tax exemption of the first spouse to die was a use it or lose it proposition. 247 Access To More Than 130 Courses.

Click on the Portability tab. New York State Department of Taxation and Finance Fiduciary Income Tax Return New York State City of New York City of Yonkers For the full year Jan. If the estate needs more time to file for portability they can apply for a 6-month extension.

If Jane as the executor of Johns estate filed an Estate Tax Return electing portability by the 5th anniversary of Johns death then Jane would have 104 million 114 exclusion in 2019. This is a scannable form. See If You Qualify and File Today.

Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. 2010 c 5 A if that estate was not required by Sec. 3019100-3 to make a portability election under Sec.

Please file this original return with the Tax Department. The election to transfer a DSUE amount to a surviving spouse is known as the portability election. Previously they only had two years to file for the so-called portability extension.

You will receive a confirmation email after you submit your request. On july 8 2022 the internal revenue service issued new guidance that allows a deceased persons estate to elect portability of their. To claim estate tax portability the estate tax representative must file an estate tax return within 9 months of the first spouses death.

The wife has to file the IRS Form 706 federal estate tax returns to get the portability within 270 days after her husbands death. For purposes of filing a Portability Return only the IRS also established an automatic extension two years from the Decedents date of death. Complete and submit the online Request for Portability.

You can check and review your status anytime online. 6018 a to file an estate tax return. The 2022 figure is up from 117 million per individual in 2021.

Please note these laws being permanent means that they are not set. The new rule also gives spouses five years to transfer to their surviving spouses the remainder of the tax-free limit that they didnt use. Required to file an estate tax return for New York State but not required to file a federal estate tax return.

You may file for an automatic 6 month extension by filing IRS Form 4768. Subscribe And Save More At CPA Self Study Online. If the portability election is filed in time the entire estate of 60 million will be named under the wife.

31 2004 or fiscal tax year beginning and ending Name of estate or trust. 2 If the Estate did not file within that two. Tax Law section 954a provides that the New York gross estate of a deceased resident means his federal gross estate as defined in the internal revenue code whether or not a federal estate tax return is required to be.

The non-exempted amount of 545 million would be portable and would be passed to his wife. An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion DSUE amount to a surviving spouse regardless of the size of the gross estate or amount of adjusted taxable gifts. The tax base for New York begins with the federal adjusted gross income and some major differences begin to emerge in comparison of the state law to the federal.

To do this youll need to file an estate tax. Some exclusions for certain sources of income exist at the state level differing from the federal law. 1 2004 through Dec.

The Estate Tax Return is due nine months from the Decedents date of death. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. 2017-34 this simplified method which is used in lieu of the letter.

When filing the taxes its important to select the portability election to have the benefits transferred to. These exemptions are as follows. Import Your Tax Forms And File For Your Max Refund Today.

100 Meals Deduction For 2021 And 2022 Ketel Thorstenson Llp

David Ha Cpa Tax Manager Los Angeles Cpa Firm

Estate And Trust Tax Prepration Pacific Tax And Financial San Marcos

What Is Form W 4 Tax Forms Signs Youre In Love Job Application Form

Tax Planning 101 Courses Ultimate Estate Planner

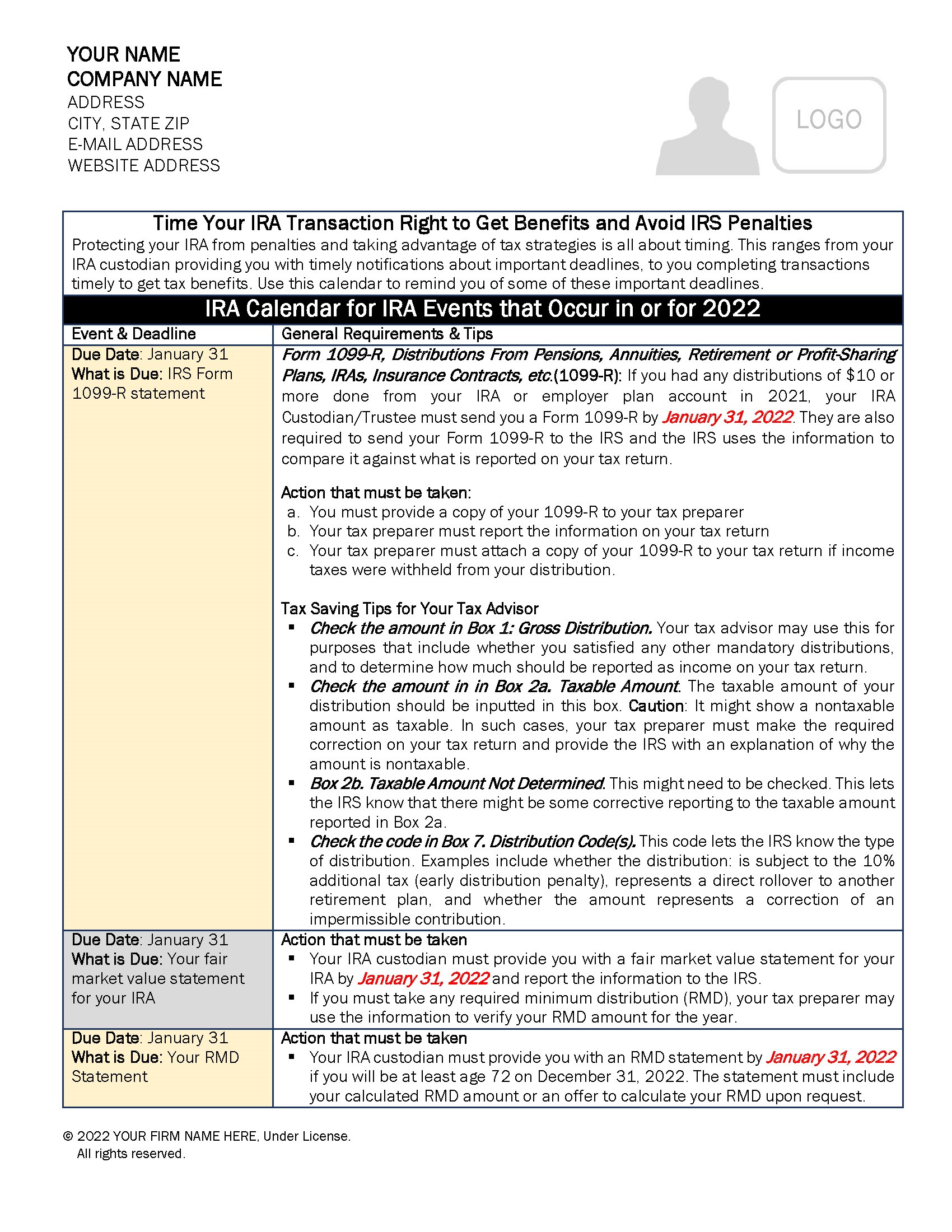

2022 Customizable Client Ira Calendar Deadlines Ultimate Estate Planner

Form 92a200 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return Kentucky Templateroller

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Tips For Filing Taxes When Married Rings Married Married Couple

Tackling Tax Issues As An Estate Executor Hantzmon Wiebel Cpa And Advisory Services

2015 Estate Gift And Gst Tax Update What This Means For Your Current Will Revocable Trust And Estate Plan The National Law Review

How Changes To Portability Of The Estate Tax Exemption May Impact You

Will Inheritance And Gift Taxes Change In 2021 Legacy Design Strategies An Estate And Business Planning Law Firm

Tax Compliance Tax Expatriation

Irs Extends Time To File Form 706 Portability Election Baker Tilly